ProPublica found landlords in at least four states have violated the ban, which was put in place by the CARES Act but has no clear enforcement mechanism.

by Jeff Ernsthausen, Ellis Simani and Justin Elliott April 16, 5 a.m. EDT

Landlords in at least four states have violated the eviction ban passed by Congress last month, a review of records shows, moving to throw more than a hundred people out of their homes.

In an effort to help renters amid the coronavirus pandemic and skyrocketing unemployment, the March 27 CARES Act banned eviction filings for all federally backed rental units nationwide, more than a quarter of the total.

But ProPublica found building owners who are simply not following the law, with no apparent consequence, filing to evict tenants from properties in Georgia, Oklahoma, Texas and Florida. The scores of cases ProPublica found represent only a small slice of the true total because there’s no nationwide — or, in many cases, even statewide — database of eviction filings.

Four landlords said they were reversing eviction filings after being contacted by ProPublica and informed the filings were illegal. National real estate trade groups, however, are already lobbying to limit the scope of the ban.

At The Life at Pine Village, a development outside Atlanta where one-bedroom apartments rent for around $850 per month, seven tenants were hit with eviction filings last week.

“Thank you for bringing this to our attention. The evictions at The Life at Pine Village were done in error and have been halted. Our team has been working today to contact all tenants who originally received notices,” said Mark Braykovich, a spokesman for Manhattan-based owner Olive Tree Holdings.

Olive Tree has a portfolio of buildings in Texas and Georgia worth more than $500 million. Braykovich said staff had been confused about what is covered by the eviction ban, noting the “unusual and quick implementation of changes in the law.”

At the Laurel Pointe Apartments in Forest Park, Georgia, the landlord filed for eviction against 25 households several days after the federal ban passed. The building is owned by Seattle-based Stonemark Housing Partners and managed by Cushman & Wakefield, a $2.5 billion publicly traded real estate services firm.

A Laurel Pointe spokesperson said that after receiving ProPublica’s request for comment: “We began a thorough investigation and determined we did unknowingly and wrongfully begin the eviction process for several residents. No residents were served or removed from their homes and first thing this morning we filed for dismissal of all evictions.”

The recent eviction filings underscore Congress’ failure to include an enforcement mechanism in the law, as well as the complexity of the ban, which only applies to certain categories of properties.

“There’s nothing in the bill that seems to create a clear penalty for violating the new law,” said Dan Immergluck, an urban studies professor at Georgia State University in Atlanta. He added it’s not clear that landlords even know about the ban.

It’s impossible to know how widespread the violations are. Eviction filings are notoriously difficult to track around the country because they are typically handled in city or county courts, only some of which post cases online, even during normal times. The roughly 120 eviction filings ProPublica found represents a review of records in just seven counties in three states, along with the entire state of Oklahoma. These places were chosen based on their population, ease of access to online records and because they had a substantial number of new cases in the past month. Several other county courts where ProPublica tried to review records have stopped posting case information altogether because of the pandemic.

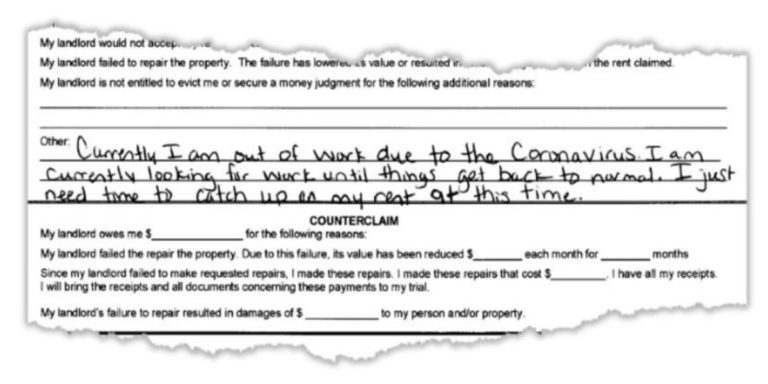

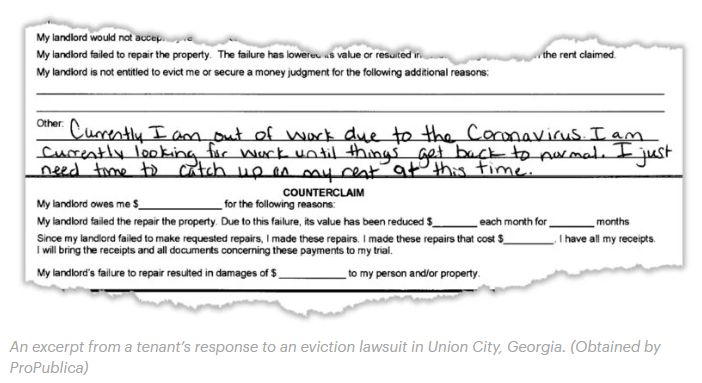

Landlords are still allowed to file some kinds of evictions at covered properties, including when a tenant is a threat to others. They are prohibited from evicting tenants for failing to pay rent. But documents for the roughly 70 cases that ProPublica was able to obtain showed landlords filed specifically for nonpayment of rent, in violation of the law.

Landlords are already lobbying to roll back the more than two-week old federal ban. In a letter to the White House and Congress this month, several national trade groups pressed for the eviction ban to be narrowed to cover only tenants “adversely affected by the outbreak, but also require residents to officially notify the property owner,” The Real Deal reported.

An eviction filing does not mean a tenant is immediately kicked to the curb. Tenants are sometimes protected by state and local laws as well. The procedure is different in every state, but under normal circumstances, it could be several weeks from the time a tenant misses the rent before a sheriff makes it to their door. Tenants facing eviction often don’t know their legal rights, advocates say, and the notice alone could cause them to leave their homes, posing public health risks in the face of an ongoing pandemic.

Even if tenants see the eviction process through, the filings can have other serious consequences. It often carries significant fees for tenants and can get them added to blacklists used by many landlords to screen potential renters. “It immediately impairs your ability to get out of the situation that you’re in, and it’s that much harder to find a landlord that will rent to you,” said Erin Willoughby, a lawyer with the Atlanta Legal Aid Society.

The CARES act prohibits landlords from charging tenants fees as well, but most of the eviction filings ProPublica reviewed show that landlords sought late fees and legal costs from their tenants. The fees vary, but typically amount to 20% to 30% of the tenant’s monthly rent. In some cases reviewed by ProPublica, attorneys’ fees alone were as high as $300.

Housing advocates around the country are struggling even to identify which buildings fall under the eviction ban, which lasts until July 25. The CARES Act lays out several categories, including buildings with federally backed mortgages and others that receive certain tax credits or participate in voucher programs. That covers more than 25% of all rentals in the country, according to estimates by the Urban Institute, or about 12.3 million units. There is no single tool or data source that tells renters, advocates or landlords if their building is covered by the ban. That makes it difficult for tenants to know if their eviction case was filed illegally or not.

Even as some landlords are violating the ban, overall evictions have dropped substantially in the regions ProPublica reviewed. In addition to the CARES Act moratorium, some states have issued their own eviction bans, and many physical court locations are currently closed to nonessential business, making it difficult to file in places where there is no online portal. While many of the illegal filings ProPublica found came days after the ban was passed March 27, records show landlords have continued to file for evictions in the past two weeks.

Most of the landlords filing evictions since the ban went into effect did not respond to requests for comment. They include Emerald Equity Group, a New York City-based firm that is best known in the industry for purchasing a portfolio of East Harlem rental buildings for more than $350 million in 2016.

Emerald’s CEO, Isaac Kassirer, is the subject of frequent stories in the business press, including for investing in rent-regulated buildings with an eye to increasing rents, tenant lawsuits and allegations of poor building upkeep. Kassirer has said that Emerald’s apartments are affordable and that he never harasses tenants.

Between March 30 and April 1, Emerald filed eviction papers on nine tenants at 13Ten Apartments, a complex in a low-income, largely black part of DeKalb County outside of Atlanta. But Kassirer’s firm took out a $47 million government-backed loan on the property in 2019, which puts it under the eviction ban in the CARES act.

ProPublica was able to identify illegal eviction filings by cross-referencing the court filings in Houston, Tampa, metro Atlanta and Oklahoma against mortgage documents and databases from the Department of Housing and Urban Development and Fannie Mae and Freddie Mac. The two government-sponsored agencies support the housing market by buying loans from lenders and reselling them to investors.

Legal experts say that, in the absence of federal penalties, landlords are unlikely to face any consequences for bringing the illegal cases in local courts.

“There’s not a lot at stake if the landlord loses the case, or if it gets dismissed,” said Eric Dunn, director of litigation at the National Housing Law Project. Many tenants don’t have the resources to challenge their cases, and the bar is high for establishing a pattern of frivolous lawsuits before a judge.

“It’s very uncommon that courts levy sanctions against landlords,” Dunn said.

Because there is no legislation relieving tenants from rent payments during the pandemic, renters who are currently protected from eviction will still be responsible for paying any back-rent when the federal and local bans are lifted.

In the absence of rental assistance, housing advocates are bracing for the worst when the eviction process returns. “We don’t want there to be a cliff that low-income renters fall off of once the moratoria are lifted,” said Diane Yentel, president and CEO of the National Low Income Housing Coalition.

Yentel’s group is advocating for additional legislation to provide funding for short-term rental assistance to ensure that tenants and landlords can continue to pay their bills.

Are you having trouble with your rent, mortgage or debts? Or do you work in the housing or debt industries and have something you think we should know about? Let us know here.

- Millions of Essential Workers Are Being Left Out of COVID-19 Workplace Safety Protections, Thanks to OSHA - April 17, 2020

- Despite Federal Ban, Landlords Are Still Moving to Evict People During the Pandemic - April 16, 2020

- COVID-19 Put Her Husband in the ICU. She Had to Be Hospitalized Next. The State Demanded to Know: Who Would Care for Their Children? - April 16, 2020