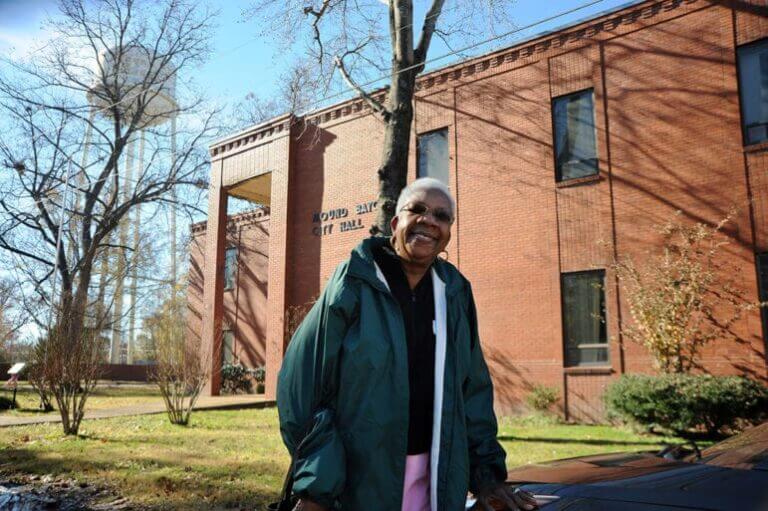

Vickie D. King/Mississippi Today

Mound Bayou Mayor Eulah Peterson near City Hall.

MOUND BAYOU — When Eulah Peterson was elected mayor here in 2017, she not only assumed the duties of the office but also inherited more than half a million dollars in debt.

Mound Bayou, a small town in Bolivar County, had accumulated $717,826.06 in debt to the IRS, Entergy, and 18 other entities. Peterson said she doesn’t know what happened in prior administrations to lead to this debt.

“They just didn’t pay the bills, as far as I know,” she said.

Peterson continued: “These were all bills that we inherited that were on the books from prior administrations. When I came in (to office) I was told, ‘It does not matter that you didn’t make the bills. You are the person in charge and the city is responsible for the bills.’”

So she went about the business of working with the board of aldermen to create a plan to pay if off.

Peterson said the city has now paid down 84% of its debts through fundraisers, tax anticipation loans, and allocations from the city general fund.

“We’re very, very proud that the board and I have worked to get this $603,958.70 paid off and in addition to that, all of our bills are current. We don’t have any bills that we’re not paying.” Peterson said.

It is not unheard of for small, rural towns to find themselves in this kind of debt.

About 50 miles southeast of Mound Bayou, the city of Itta Bena was potentially going to lose its power because of $800,000 in unpaid bills before the state intervened.

Hope Policy Institute Director Diane Standaert said that lack of wealth in some rural, small towns can be understood through the lens of policies that have historically divested from these kinds of places.

“Generally, the big picture of smaller town finances is not disconnected from what’s happened in the region in terms of the history of extraction and exclusionary policies and practices. (That includes not) only extractive policies but a divestment, and not getting resources whether it be philanthropic public or private dollars into these communities on an ongoing basis,” Standaert said.

Willie Simmons, central district transportation commissioner and former state senator of more than 26 years representing the Delta, agreed that state and national policies have tended to not prioritize small-town economic development.

Vickie D. King/Mississippi Today

Standing near the former home of Mound Bayou founder Isaiah Montgomery, Mayor Eulah Peterson describes how during more prosperous times, the train travelled through the center of town past the founder’s house.

Rural Mississippi — especially the Delta — lacks the necessary infrastructure to attract and maintain a thriving population. With a loss of population, so goes economic development, employment opportunities and new business.

“We have to rethink what we have done in the past if we want to have a holistic state, if we want to have a holistic nation,” Simmons said. “We have to invest in those communities that we may have neglected in the past due to public policies and population migration, and begin to invest in those communities so that they can grow.”

Though these types of policies are not the sole reason for Mound Bayou’s debt, they have played a role in what the city couldn’t afford to do while paying it off. And now that the town is mostly out of debt, Peterson said the town can prioritize infrastructure projects.

She wants to fix the streets and sewer systems as well as revitalize the community center. This June she plans to run for re-election so she can continue on the work she’s started. If not successful, she’ll continue to push for the rest of the debt to get paid off before the new mayor comes into office.

“It became a goal of mine to not have a new administration come in with these debts over their heads,” Peterson said.

The post Mound Bayou leadership pays off nearly $700,000 in inherited debt appeared first on Mississippi Today.

- Archives and History teaching Mississippians basics of genealogy - February 17, 2026

- Republicans are pushing DHS over ICE warehouse purchases - February 17, 2026

- Social worker: Mississippi’s paid family leave law is a start, not the finish line - February 17, 2026