by Samuel Hughes with contributions from Miracle Jennings, Rowan Luke, Mallory Strickland, Srividya Karuturi, Gretta Graves, Gerome Webster

GULFPORT — Tall grass creeps up boarded windows. Overgrown lots hold little but broken glass and flat tires. Rotten porches sag under the weight of years of neglect. These sights of urban decay are common in Mississippi – and cleaning them up is not a simple job.

State leaders explain fixing the problem requires more than cutting the grass or tearing down crumbling homes. Many of these properties are caught in legal and financial gridlock, leaving cities without the resources to maintain or clear them for redevelopment.

How properties fall into disrepair

In neighborhoods across Mississippi, abandoned properties aren’t just neglected — they’re stuck in a cycle that keeps them from being restored.

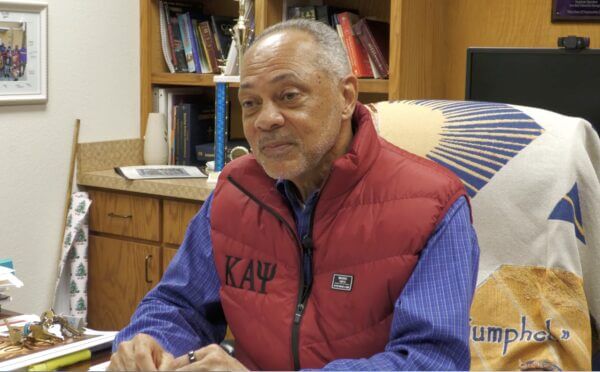

Rev. John Whitfield has seen it firsthand in Gulfport. As pastor of Morning Star Baptist Church, he has watched homes deteriorate as families move away, taxes go unpaid and legal complications pile up.

“A lot of these properties become the way they are because parents will die, the children will not follow through with probating an estate, back taxes become due and they go unpaid,” Whitfield said. “The properties are then purchased at an auction, or they will lapse back to the state, and the state will take them for these back taxes.”

But many of these properties don’t get fixed. Buyers at tax auctions often don’t live in the community — and sometimes, they never intend to fix the property at all. ; others walk away once they realize the cost of repairs exceeds potential returns, leaving properties to sit untouched for years.

“As a consequence, it’s just a matter of neglect. It’s neglect on the part of families; it’s neglect on the part of heirs; it’s neglect on the part of elected officials,” Whitfield said. “It’s neglect on the part of those people who come into possession of these blighted and dilapidated properties; it’s neglect on the part of the State of Mississippi – the Secretary of State’s Office – who may come into possession or ownership of these properties.”

Whitfield believes systemic change is needed — not just in how the state handles abandoned properties, but also in how much financial support is available for communities struggling to clean them up.

The challenge for cities

While abandoned residences and empty lots look similar from the street, the cleanup process is different between properties owned privately and those owned by the state.

Under the current system, when a privately owned property is reported for disrepair, code enforcement officers are sent to do an assessment. If the property meets the legal definition of blight, they can issue warnings or order the property owners to make repairs.

For abandoned private properties, a public hearing is scheduled – typically with a two-week notice – to determine the next steps. However, many of these properties are owned by out-of-state investors or heirs who fail to show up, leaving cities with limited options.

At that point, cities can clean the property and bill the owner, but many local governments lack the revenue to pay for the cost on the front end, especially without a guarantee the owners will pay.

When it comes to properties already under state control, limitations increase. Rep. Shanda Yates, an Independent from Jackson, said part of the problem is the way the rules are set up when it comes to buying property through a tax sale.

“Right now, the way that properties are sold at tax sale is: you have your tax sale, if someone purchases the property or taxes, there’s a two-year redemption period,” Yates said. “During that two-year redemption period, nothing can be done to the property. Nobody can go in and clean it up or maintain it, tear down any dilapidated structure – essentially nothing.”

Yates explained if someone buys delinquent property taxes, the property owner must pay those taxes back at 18% interest to that buyer or lose their property.

“It’s stuck as sort of a holding period waiting to see if the original owner who did not pay the taxes is going to come forward, pay the taxes and reclaim their property,” Yates said.

After the redemption period, Yates explained, the person who bought the taxes can take the deed and own the property – or, more often than not – they refuse the deed and the property ownership goes back to the local governments to be sold again.

“There’s no end to how many times a property can be stuck in that cycle,” Yates said.

Ending the tax cycle

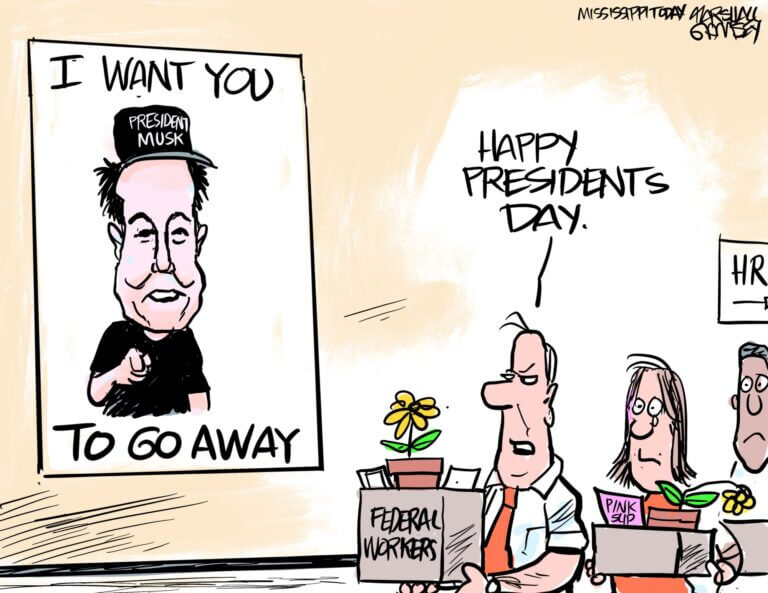

Yates sponsored two bills in the House to prevent properties from falling into the tax-sale cycle for decades and slowly falling into further disrepair.

Under House Bill 1198, after the end of the first cycle, if the purchaser of the delinquent taxes does not accept the deed, the property would go to the state and fall under the management of the Secretary of State’s Office.

Then, if enacted, House Bill 1199 would allow the Secretary of State’s Office to utilize any proceeds from selling tax-forfeited properties to maintain other state-owned, previously forfeited properties, to lessen the burden of maintenance on cities and counties.

The Mississippi Municipal League is also pushing for a Property Cleanup Revolving Fund. As outlined in House Bill 733 and Senate Bill 2023, the fund would establish a $5 million fund for low-interest loans for larger cities and grant opportunities for smaller ones to clean up blighted properties.

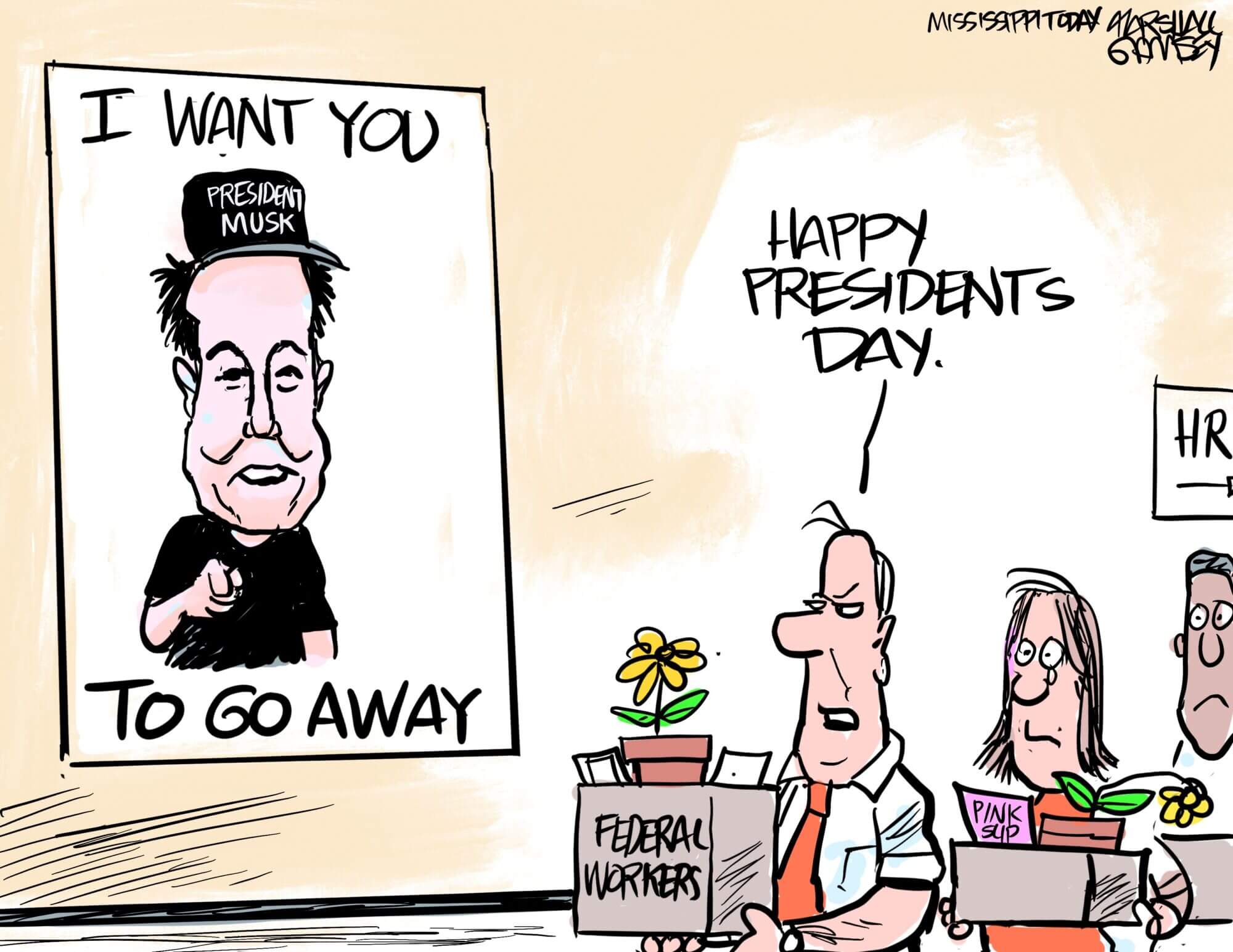

Rep. Randy Rushing, R-Decatur who sponsors House Bill 733, called it a base for building a much-needed support system.

“Having been a mayor of a small town, your funds are limited, and you have to prioritize your funds. So, when it comes down to the pecking order, cleaning up a dilapidated old structure or cleaning up a lot that is an eyesore is way down on the list when it comes time to do your budget every year. In a lot of municipalities and cities, it just doesn’t get done,” Rushing said.

“By creating this fund that strictly can only be used for that particular purpose, it allows a tool for our municipal government officials to reach in and borrow that money, or in your small towns’ case, it would be a grant to clean up a specific problem area,” Rushing continued.

Offsetting the burden with investors

Several lawmakers, including Rep. Jeffrey Hulum, D-Gulfport sponsored bills in the 2025 legislative session aimed at addressing blight and soothing cities’ financial roadblocks. One of the key measures Hulum outlines is $350,000 in state appropriations for West Gulfport.

For Hulum, it’s an issue of public safety, public health and economic vitality.

“When I drive around my city, when I drive around my district, and I see all the blighted properties, the rundown housing, the overgrown lots; You start to think, ‘As an investor, would you invest in that area?’ And when the answer is no, you say, ‘What can I do to help the people?’ … You’ve got to go above and beyond the municipality to the state level and try to bring monies to the municipalities to improve that area,” Hulum said.

Yates believes, while using state funds for special projects can be effective in clearing blighted areas, providing developers incentives to develop state-owned property offers a long-term solution to improving state-owned blighted property.

Yates said House Bill 1201 could be the solution. The legislation proposes tax credits for developers who purchase state-owned, tax-forfeited property. In her district of Jackson, she’s seen first-hand the cost conundrum investors face.

“We know that there are housing developers that would be interested in coming in and buying chunks of property and building affordable housing,” Yates said. “An average house, from what we’ve been told, would cost about $150,000 to build. Unfortunately, in the current market and in the current areas where the housing is needed, it’s not going to sell for $150,000 – probably closer to $95,000 … So, the tax incentives would allow the developer to remain whole.”

Currently, there are solutions to making the numbers work for developers, according to David Perkes, director at Mississippi State University’s Gulf Coast Community Design Studio. Gulfport, for example, receives U.S. Department of Housing and Urban Development Community Development Block Grants and federal HOME funds that can be used as grants to help cover the cost of construction, to fill the gap in neighborhoods that suffer from low property value.

Perkes said these federal programs, along with other community development efforts, can help to raise property values in communities, enabling property owners the assurance and ability to invest in their property.

“I would love for our elected officials to take serious: renovating, removing, improving blighted properties and dilapidated homes within our communities, to provide grants for those people on fixed incomes to make the improvements necessary for their houses to become not an eyesore, but to become the primary attraction on that block,” Whitfield said.

“If we invested in people through community development corporations, and had the very people who live in those communities to help bring about this change, then you have ownership, where people feel like they have invested something in it — whether sweat equity or money out of their pocket — then they will protect it and they will begin to police themselves.”

Outlook for state-owned lots

Assistant Secretary of State Lands William Cheney believes, regardless of what legislation is passed, any funding to the Secretary of State for maintenance will give cities more options for reimbursement if they look to maintain state-owned lots.

“Before the legislature changed the funding in 2016, we had a couple hundred thousand dollars. It was never a huge amount, but it was enough to help keep the grass cut twice a year,” Cheney said. “But what they’re now talking about is like a couple million. Now, if it is a couple million, that’s cutting grass, that is demolishing some of these homes.”

State-owned properties in Southeast Mississippi

- Forrest: 249

- George: 11

- Greene: 2

- Hancock: 273

- Harrison: 126

- Jackson: 238

- Lamar: 21

- Pearl River: 114

- Perry: 0

- Stone: 2

Following a housing market crash in 2013, the Secretary of State had an inventory of 20,000 properties statewide in 2014. Now, through aggressive efforts to auction these properties, it has an inventory of about 6,800 properties, about 2,000 of which are in Hinds County.

Cheney said in many areas, such as those with poor infrastructure or a lack of civil services, a holistic approach is required to sell state-owned lots back onto the tax roll.

“It’s not just, ‘Oh, give the state some money to cut the grass.’ Well, if it’s got a bad road, you’re still not going to sell it. It doesn’t matter whether that piece of property is in the city limits of Jackson, on the Coast, or anywhere; if you don’t want to live on it, I’m going to have a hard time selling it,” Cheney said.

The post Mississippi lawmakers aim to tackle abandoned properties appeared first on Mississippi Today.